child tax credit 2021 dates by mail

Important Tax Filing Dates and Refund Dates. If you file your income tax or fiduciary return on a calendar year basis you must make your first estimated tax payment for 2022 by April 18 2022.

EITC or the Additional Child Tax Credit until.

. The Internal Revenue Service reminds taxpayers and tax professionals to use electronic options to support social distancing and speed the processing of tax returns refunds and payments. The date or dates of your 31-day period of. 281 Public Law 116-136 116th Congress An Act To amend the Internal Revenue Code of 1986 to repeal the excise tax on high cost employer-sponsored health coverage.

Homeowner tax rebate credit. An additional factor coming into play is heightened identity theft awareness. Here are the Canada Child Benefit dates for 2022.

116th Congress Public Law 136 From the US. For the first time in US. The IRS is sending families half of their 2021 Child Tax Credit as monthly payments of 300 per.

For the 2021 base year payment period is between July 2022. If you received advance child tax credit payments during 2021 you will receive Letter 6419. For many families this can result in an additional 300 per.

Mail thieves strike in Norridge and Harwood Heights leaving at least 40 victims New video released Tuesday shows a thief swiping letters from a blue mailbox in the northwest suburbs. Indiana estimated income tax payment due dates are the same as the federal Form 1040-ES payment due dates. Shared Custody Of A Child GST Tax Credit.

CCB payment amounts for July 2022 to June 2023 payment cycle are based on your familys net income for the 2021 tax year. The PDF file format. You will use the information from this notice to figure the amount of child tax credit to claim on your 2021 tax return or the amount of additional tax you must report on Schedule 2 Form 1040.

Mark Elliot Zuckerberg ˈ z ʌ k ər b ɜːr ɡ. If you enrolled someone who is not claimed as a dependent on your tax return or for more information see the Instructions for Form 8962. Government Publishing Office Page 134 STAT.

Correct third stimulus amount or Advanced Child Tax Credit on your tax return when trying to claim the recovery rebate credit or the rest of the 2021 Child Tax Credit your return will require further review by the IRS which will delay. The 2021 advance monthly child tax credit payments started automatically in July. You may also be eligible to claim the Georgia Low Income Credit Child and Dependent Care Disabled Person Qualified Caregiving Disaster Assistance and other credits.

Advance child tax credit payments. Advance child tax credit payments. To protect the public and employees and in compliance with orders of local health authorities around the country certain IRS services such as live assistance on telephones.

And Jan 15 2023. Estimated tax payment due dates. IR-2021-169 August 13 2021.

The IRS is required by federal law to withhold tax refunds for taxpayers who claim Earned Income Tax Credits and Additional Child Tax Credit until at least Feb. The contractor shall mail or deliver the NOA to the parents at least 14 calendar days before the effective date of the intended action. The names gender and birth dates of all children under the age of eighteen in the family whether or not they are served by the program.

If the NOA is mailed the 14 calendar day period is extended by 5. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000. The advance child tax credit payments were early payments of up to 50 of the estimated child tax credit that taxpayers may properly claim on their 2021 returns.

And it will be based on your 2021 tax returns. The maximum amount you can elect to deduct for most section 179 property including cars trucks and vans you placed in service in tax years beginning in 2021 is 1050000. PDF 712KB Tip This text has been loaded in plain text format due to the large size of the XMLHTML file.

Tax return filers claiming Additional Child Tax Credits ACTC and Earned Income Tax Credits EITC may have their refunds held up by the IRS for several weeks. Keep this notice for your records. You can either pay all your estimated tax with this first.

People who dont use direct deposit will receive their payment by mail around the same time. Are the same as the federal Form 1040-ES payment due dates. Loading the XMLHTML in a new window 1MB may take several minutes or possibly cause your browser to become unresponsive.

For the 2022 tax year estimated tax payments are due quarterly on the following dates. IR-2021-153 July 15 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin. History recipients receiving CTCs can also receive half of the credit as an advance child tax credit payment.

2022 IRS tax deadline postmark deadline for 2021 tax return filing tax season start date estimated payment deadlines where to e-file. Advance Child Tax Credit Payments. Every province including Ontario will have the same dates that the GSTHST credit is deposited.

Instead it refers to the date that the tax return is postmarked. From July through December 2021 advance payments were sent automatically to taxpayers with qualifying children who met certain criteria. The tax filing deadline for most individuals and businesses for the 2021 tax year is April 18 2022.

Income tax refund or GSTHST credit. Born May 14 1984 is an American media magnate internet entrepreneur and philanthropistHe is known for co-founding the social media website Facebook and its parent company Meta Platforms formerly Facebook Inc of which he is the chairman chief executive officer and controlling shareholder. Department of Revenue we do not alter them in any way.

So if you mail out your tax return on April 18 by USPS mail and the IRS receives. The credit is issued at a federal level not provincial. Child tax credit and the additional child tax credit.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of August as direct deposits begin posting in bank accounts and checks arrive in mailboxes. Learn about the Canada Child Benefit CCB amount how it is calculated and application process. If advance payments of the premium tax credit were made you must file a 2021 tax return and Form 8962.

From July through December 2021 advance payments were sent automatically to taxpayers with qualifying children who met certain criteria. The advance child tax credit payments were early payments of up to 50 of the estimated child tax credit that taxpayers may properly claim on their 2021 returns. For the 2022 tax year estimated tax payments are due quarterly on the following dates.

Even though child tax credit payments are scheduled to arrive on certain dates you may not have gotten the money. The IRS tax refund schedule dates could be held up until Feb 15. If you opted to receive your tax refund via mail it could take several weeks for your check to arrive.

Always Keep Employee Td1 S Up To Date Tax Credits Hiring Employees New Bus

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

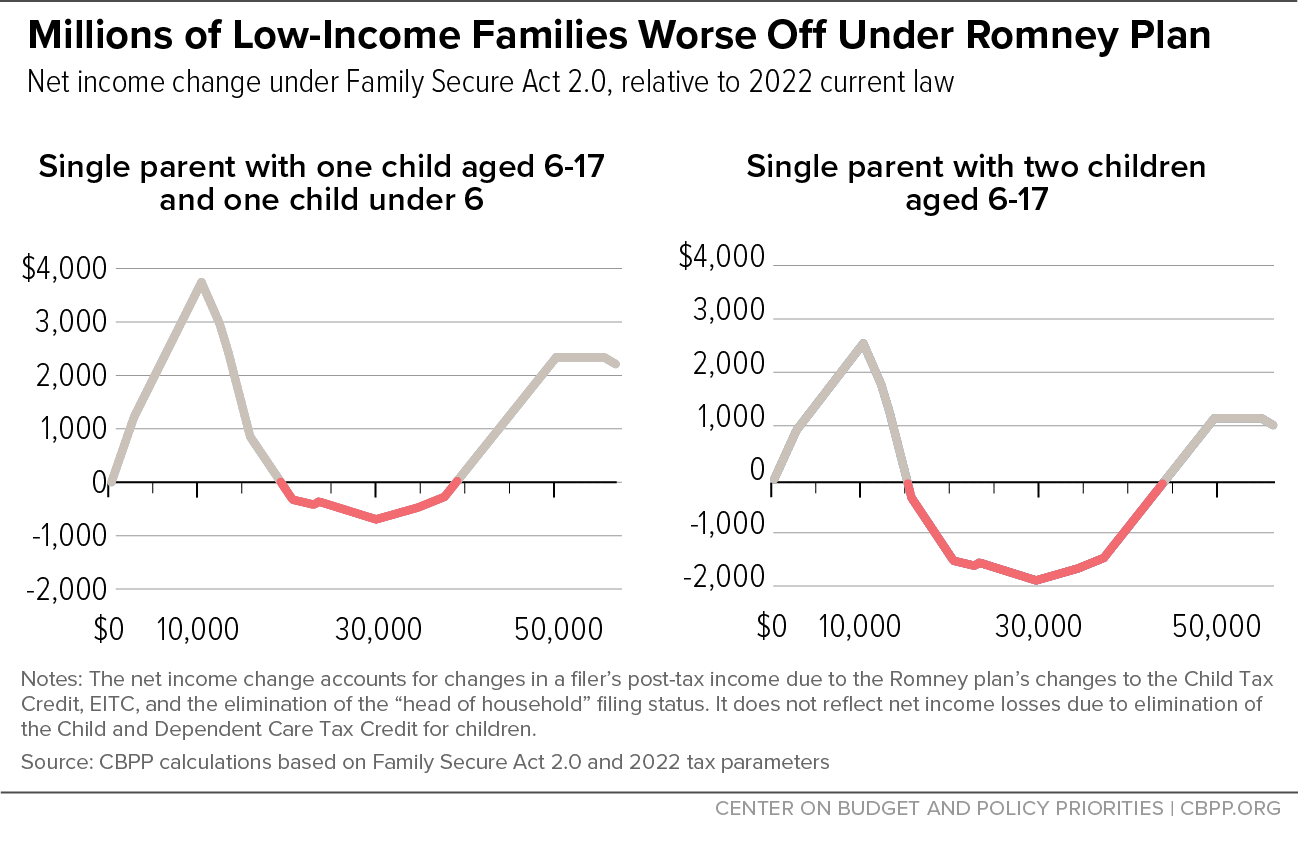

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

2021 Child Tax Credit Definition Faqs How To Claim Nerdwallet

Parents Of 2021 Babies Can Claim Child Tax Credit Payments Here S How Cnet

Child Tax Credit U S Senator Michael Bennet

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

Childctc The Child Tax Credit The White House

Despite Flaws Romney Proposal On Child Tax Credit Creates Opening For Bipartisan Action Center On Budget And Policy Priorities

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Child Tax Credit Info United Way For Southeastern Michigan

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities